Part I: Foundation and Transformation: From Son of the “King of Ships” to Real Estate Tycoon

The story of Hui Sai Fun begins with his father, Hui Oi Chow, Hong Kong’s first-generation “King of Ships.”

Starting humbly from a small grocery store in Zhanjiang, Guangdong, Hui Oi Chow saw an opportunity where others didn’t. He ventured into the shipping business and founded Shun Cheong Steam Navigation Co., Ltd., eventually rising to become one of Hong Kong’s leading shipping magnates. It was through this success that he built the family’s first great fortune.

A Bold Shift From Sea to Land

Two Sons, Two Paths—And a Father Caught in Between

Yet, beneath the surface of his success, Hui faced astorm he could not control, the question of succession. He had two sons: Hui Chun Kin, the talented and disciplined elder son groomed to be his heir, and Hui Chun Hang, the younger son whose carefree lifestyle earned him the media’s “playboy” label.

When the Groomed Successor Is Suddenly Gone

The sudden passing of Hui Chun Kin in 2008 was a devastating blow. Not only did Hui lose his beloved son, but also the successor he had carefully prepared to carry the family banner. With only his younger son remaining and clearly uninterested in the business, Hui found himself facing an agonizing reality.

___________________________________________________________________________________________________________________________________________________________

Part III: Farsighted Guardianship: The Wise Choice of a Family Trust

___________________________________________________________________________________________________________________________________________________________

1. A Visionary Structure:

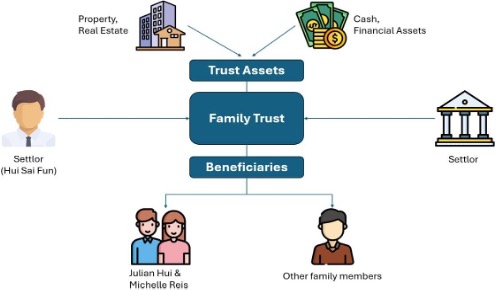

Separating Ownership, Control, and Benefit

Unlike many patriarchs who simply divide assets among heirs, Hui Sai Fun took a disciplined and forward-looking approach. His estate, reportedly worth over HKD 40 billion,was not directly passed to his surviving son, Hui Chun Hang. Instead, he had planned every detail years in advance.

(I) Philanthropy

Roughly half of Hui’s fortune was dedicated to charitable causes, reflecting his long-standing belief in giving back tosociety. A principle that also helped reduce potential inheritance disputes.

(II) Trust as the Core

The remaining assets, valued at over HKD 20 billion, were placed into a family trust. This trust became the central pillar of Hui’s estate plan, encompassing key commercial properties such as the Central Building in Hong Kong’s Central District, and personal residences like the No. 10 Tai Long Wan Road mansion, where Hui and his son once lived.

(III) Fixed Monthly Distribution

Under the arrangement, beneficiaries (including Hui Chun Hang, Michelle Reis, and other family members) do not own or have direct control over the trust’s principal assets. Instead, they receive regular monthly allowances, reported to be around HKD 2 million for Hui Chun Hang and Michelle Reis. This ensures comfort and stability without exposing the core assets to personal financial risks or impulsive decisions.

(IV) Professional Management

2. A Father’s Love, Planned Far Ahead:

Balancing Provision and Restraint

Love Expressed Through Long-Term Vision

- Securing Livelihood: At its core, the trust ensured that Hui’s son and future generations would live in lifelong comfort. With fixed, predictable allowances, the family could maintain a first-class standard of living without bearing the burdens of day-to-day business management or financial stress.

- Preventing Wealth Dissipation: More importantly, the structure itself acted as a protective shield. By separating ownership from benefit, Hui effectively eliminated the risk of core assets being sold, divided, or lost to poor judgment. Regardless of personal choices or changing circumstances, the family’s key holdings would remain intact — ensuring that the wealth he built could endure for generations.

- Avoiding Family Conflict: Hui’s clear and transparent trust arrangement also helped avert the inheritance disputes that have so often torn wealthy families apart. By defining rights and responsibilities in advance, he preserved not only his assets, but also family harmony which something money alone can never buy.

___________________________________________________________________________________________________________________________________________

Hui Sai Fun’s choice transcended the traditional model of sons directly inheriting their fathers’ businesses, showcasing a more modern, rational, and robust philosophy of wealth succession. He left behind not just a commercial empire, but an institutional armour designed to ensure its enduring existence.

In many ways, Hui Sai Fun’s decision marked a shift from the traditional idea of “passing the baton” to the next generation. Instead, he embraced a modern and institutional approach to legacy — one rooted in protection,governance, and long- term vision.

He did not just leave behind a fortune.

He left behind a system.

___________________________________________________________________________________________________________________________________________________________

Part IV: Beyond Trusts: Labuan Foundation – An Alternative Strategic Choice for Wealth Succession

Core Advantages of a Labuan Foundation

Legal Entity Status: Unlike a trust, the foundation is its own legal entity — able to own assets, enter contracts, and operate independently, offering greater transparency and simplicity.

- Founder’s Control & Vision: The founder can set clear objectives, governance rules, and distribution terms through the Charter, Articles, and Family Constitution, ensuring long-term alignment with family values and vision.

- Strong Asset Protection: Foundation assets are legally separated from the founder, council, and beneficiaries, creating powerful protection against creditor claims, marital disputes, and political or economic risks.

Privacy & Tax Efficiency:Labuan offers confidentiality with no public disclosure of foundation details, alongside a favourable tax regime — including low or zero tax on non-Malaysian income — supporting efficient estate and wealth planning.

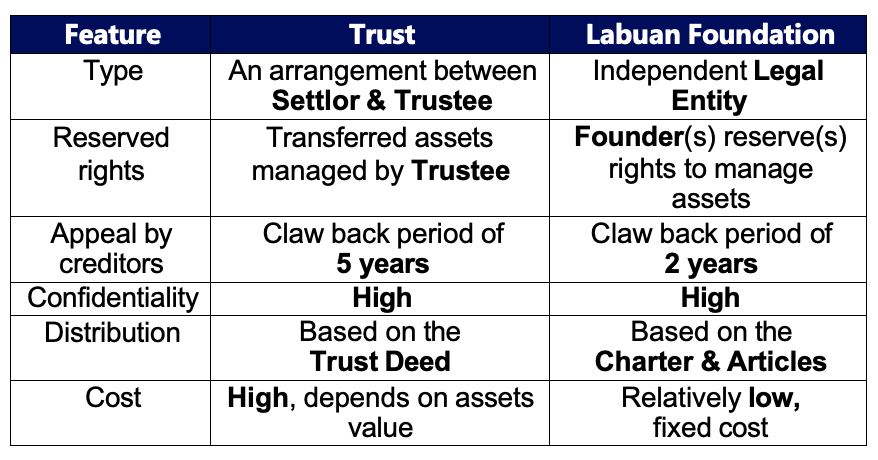

Comparison between Trust & Foundation

________________________________________________________________________________________________________________________________________________________

Conclusion

Hui Sai Fun’s family trust proved both successful and strategic. The Labuan Foundation offers an alternative route to achieve similar goals—protecting core assets and securing future generations—especially for ultra- high-net-worth families seeking clear, enforceable terms within an Asian jurisdiction.

- https://www.instagram.com/p/DNUIXKFimon/

- https://www.sohu.com/a/720266444_121123708

- https://zhuanlan.zhihu.com/p/649515429

- https://zhuanlan.zhihu.com/p/52235723

- https://www.sohu.com/a/477626574_120620360

- https://zhuanlan.zhihu.com/p/283894131

___________________________________________________________________________________________________________________________________________________________

Final Thought:

With the right advisors like CORE ADVISORS and tools like Family Offices and Labuan Private Foundations, families can secure their legacies without costly disputes.

Discover more about Core Advisors Limited and the services it provides

The Heir Who Built Beyond the Waves: Hui Sai Fun’s Journey from Shipping Fortune to Real Estate Empire

Part I: Foundation and Transformation: From Son of the “King of Ships” to Real Estate Tycoon The story of Hui Sai Fun begins with his

The Family Feud Over Wang Yung-Ching’s Fortune; And What We Can Learn From It

Introduction Wang Yung-Ching, known as the “God of Management” in Taiwan, was the legendary founder of Formosa Plastics Group, a sprawling business empire spanning petrochemicals,

Do You Really Need Investment Advisor Services? Here’s How to Decide

The internet is full of information about how to increase your wealth and secure your financial future. However, the more information there is, the more

Top Mistakes People Make Without an Experienced Wealth Management Advisor

When it comes to wealth management, the temptation of quick online tips and DIY solutions can be strong. But in the absence of the knowledge

How Wealth Management Planning Evolves as You Grow Your Wealth

Money is not stagnant and neither should your financial management plan be. At Core Advisors Ltd., we believe that wealth management planning is an ongoing

How a Good Investment Advisor Can Save You More Than They Cost

When it comes to managing your wealth, taxes, and financial future, hiring a quality investment advisor is an investment, not a cost. At Core Advisors

Add Your Heading Text Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.