Money is not stagnant and neither should your financial management plan be. At Core Advisors Ltd., we believe that wealth management planning is an ongoing process, not a formula. As your financial life becomes more complicated, the tools and strategies you use must evolve alongside it. Your strategy should evolve as you progress through the stages of accumulating assets or preparing to transfer them.

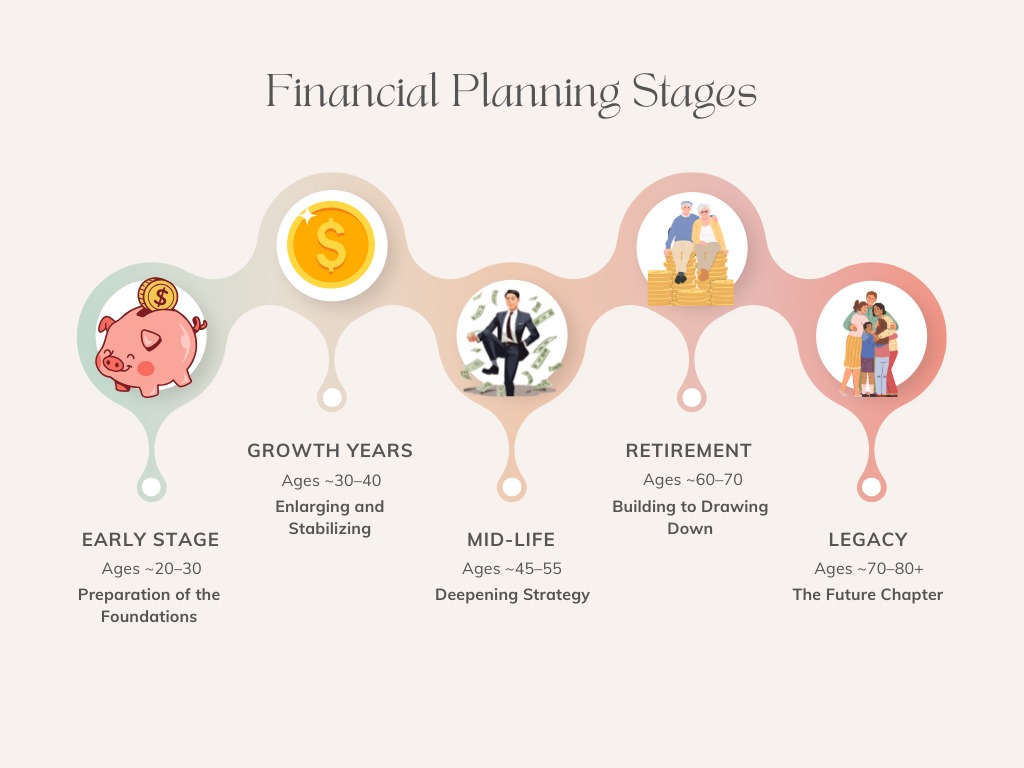

This is how wealth management planning usually evolves throughout the different stages of your financial life.

Early Stage: Preparation of the Foundations

At the very start, planning is directional. You focus on saving, paying off debt, setting up emergency funds and making initial investments. The focus is on building momentum rather than complexity.

At this stage, wealth management planning helps you to establish good financial practices. Selecting the right investment accounts, understanding your risk tolerance, and adopting a long-term mindset are key to developing true wealth over time. Even simple decisions made early on can have a significant impact.

Growth Years: Enlarging and Stabilizing

The more you earn, the more your financial life will develop. Here, wealth management planning becomes a strategy. You will save more, invest in several areas and encounter new financial choices, such as buying a house, saving for your children’s education or starting a business.

You are likely to encounter new risks during this stage, such as tax exposure, market volatility and lifestyle creep. A good plan helps you to increase your wealth and prevents growth from becoming a burden. At Core Advisors Ltd., our clients are able to incorporate their financial objectives into one plan that shows where they are and where they want to be.

Mid-Life: Deepening Strategy

By your 40s or 50s, you may be earning more than ever, but the stakes are also higher. Retirement is no longer hypothetical, and tax efficiency becomes important. You probably have a combination of savings accounts, property investments, and business interests, and making the wrong decisions can be expensive.

This is where wealth management planning enters the optimisation phase. It’s not just about saving; it’s also about planning how and when to withdraw money. You are thinking differently about risk. You may be considering charitable donations, estate planning or ways to reduce future tax liabilities.

This is when the advantages of having a good advisor begin to pay off. Small choices such as where to invest your assets, when to withdraw funds, and how to rebalance can generate long-term value and save you a fortune without you realising it.

Retirement: Building to Drawing Down

Once you reach retirement, however, it all changes. Now, attention is paid to distribution. You need to generate predictable revenue from your portfolio, control your medical expenses and minimise additional taxes.

Wealth management planning in retirement is a delicate coordination process. When should you claim your Social Security benefits? How should you withdraw from various types of accounts? How should required minimum distributions be managed?

We support our clients through this process by creating flexible plans that can be adapted as life, markets, and laws change.

Legacy: The Future Chapter

At some point, wealth management is no longer just about your lifetime. You may want to support your children, promote causes you believe in or pass on your values and wealth.

The final stage of the planning process focuses on estate strategy, charitable giving and inter generational wealth transfer. It is about control, clarity, and intention. Without a plan, your wishes may not be honored, or your heirs may not be ready.

At Core Advisors Ltd., we support our clients through this stage in a way that is purpose-driven as well as number-driven.

Why Choose Core Advisors Ltd. for Wealth Management Planning

The strength of wealth management planning depends on the individuals who support it, and that is where we intervene. We combine financial expertise with a client-centric approach. There are no off-the-shelf solutions or sales pitches; just intelligent, customised plans to support your objectives.

Here’s what sets us apart:

- We provide fiduciary advice and are fee-only, so you can be sure that we are acting in your best interest.

- We provide tax-sensitive planning in all phases of your plan.

- We build long-term relationships that evolve with you, because your plan should never stay the same.

- We are always open and direct.

Whatever you need to build, maintain or plan your legacy, we are here to help you through every step.

Conclusion

Wealth is not only about the figures; it’s about having a plan that helps you live the life you desire. Your financial plan should be flexible enough to adapt to changes in your financial situation and growing assets. That is what intelligent wealth management planning is all about.

We are Core Advisors Ltd., and we don’t just respond to change — we help you plan for it. Are you just beginning to accumulate wealth or looking to adjust your legacy plan? We can help ensure your plan stays one step ahead.

Your goals are dynamic. Your plan should be too. Let’s build it together.